What are PFAS, and why are they a problem?

PFAS, short for per- and polyfluoroalkyl substances, are a family of synthetic chemicals that have been in use since the 1950s. These chemicals are commonly found in non-stick pans, waterproof jackets, stain-resistant carpets, the photo imaging industry, the metal/semiconductor industry, biocides, food packaging, and even in firefighting foams. What makes PFAS unique and so prolific is their strength; the carbon-fluorine bonds in these compounds are among the strongest in chemistry, which, while beneficial for product durability, is detrimental to the environment. Thus, earning them the nickname: forever chemicals.

PFAS are highly mobile in air, soil, and water, causing them to spread across environments, from farmland to remote rivers, eventually bioaccumulating in animal and human bloodstreams. They have been linked to serious health issues, including cancer, immune suppression, and liver damage.

Despite the risks, PFAS have been used in everything from electronics to cosmetics, but that’s starting to change. As awareness grows, governments and companies are starting to pivot away from these persistent pollutants. For a detailed look at how PFAS production and regulation have evolved over time, see this PFAS timeline.

The Rising Wave of PFAS Regulations

Governments around the world are cracking down on PFAS, starting with consumer goods.

| The Rising Wave of PFAS Regulations | |||||||

|---|---|---|---|---|---|---|---|

| Continents/ Countries |

United States | Europe | |||||

| Assembly Bill/Country | California AB 2762 | California AB 1817 | Colorado | EPA | ECHA | France | Denmark |

| PFAS compounds | Banned 13 compounds (PFOS, PFOA, PFNA) | PFAS | PFAS | PFAS, including PFOA, PFOS | PFAS | PFAS | PFAS |

| Industry | Cosmetics | Textiles | Outdoor gear & Household products | Drinking Water | Textiles, cosmetics, food packaging, foams | Cosmetics & waterproof textiles | Clothing & food packaging |

| Effective Year | 2025 (Jan 1) | 2025 (Jan 1) | 2028 | 2029 | 2026 | 2026 | 2026 |

Industry Response:

Amid growing scrutiny and legal pressure, major chemical manufacturers are pivoting away from PFAS.

- 3M has announced it will cease PFAS production by 2025, following billions of dollars in legal settlements.

- DuPont and other chemical companies are currently facing over 10,000 lawsuits linked to PFAS exposure.

These legal actions are shaping a future where PFAS-free becomes the new normal. The clock is ticking for manufacturers to innovate PFAS-free alternatives now or be left behind.

IP Landscape:

The intellectual property (IP) landscape for PFAS-free alternatives (such as biological wax emulsions, organosiloxane compounds, polycarbodiimide-based solutions, polyurethane-based solutions) is experiencing a patent boom, largely driven by global regulatory pressure. MaxVal’s prior art analysis in this space reveals that R&D is dominated by universities (~60% of top filings). China has emerged as the global innovation engine, holding the highest share of patent priority filings and outpacing U.S. major corporate patentees such as Mitsubishi, Evoqua Water Technologies, and Toray, which are commercializing new solutions, with the chemical, fertilizer, and rubber industries having the most patenting activity.

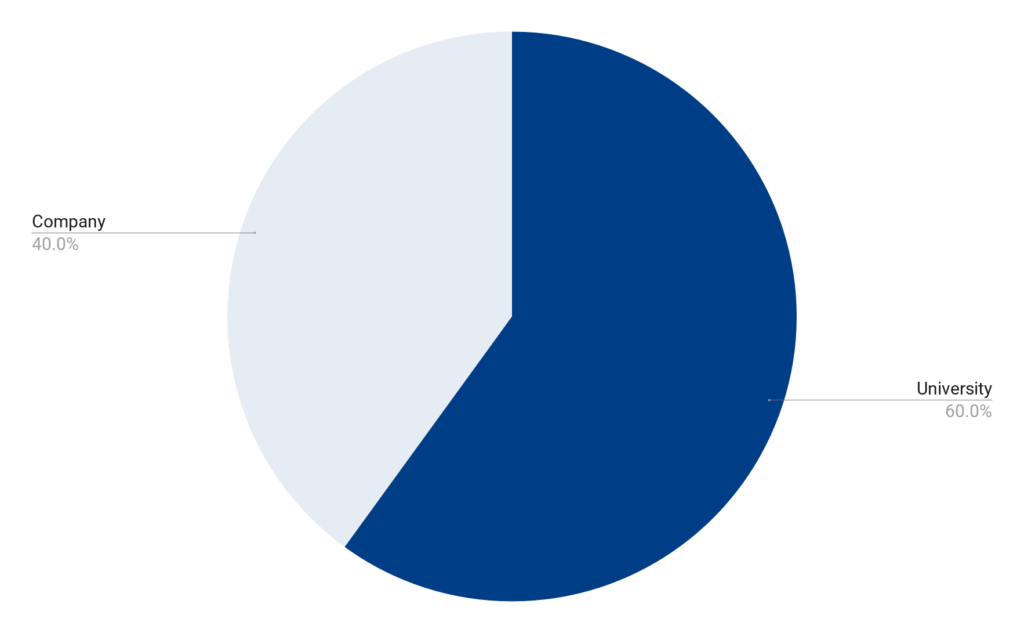

- Company vs University:

Insight: The analysis shows that approximately 60% of the top PFAS-free filings were made by universities, spanning a wide range of industries, including chemicals, fertilizers, rubber, electronics, and paints & coatings. In contrast, around 40% of the patents were filed by tech giants.

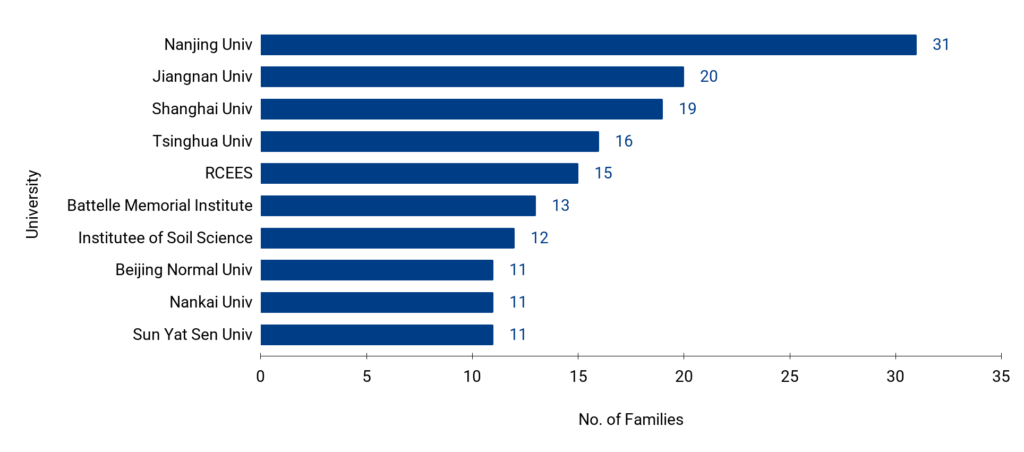

(i) Top Universities:

Insight: While Western regulations (from the EPA and ECHA) are driving the urgent global demand for PFAS-free alternatives, Chinese universities, led by Nanjing University, are dominating the R&D and intellectual property landscape. This strategic focus on patenting next-generation materials positions China to become the key technology licensor, potentially obligating Western companies to acquire the very “green” technologies they are legally required to adopt, from Chinese patent holders.

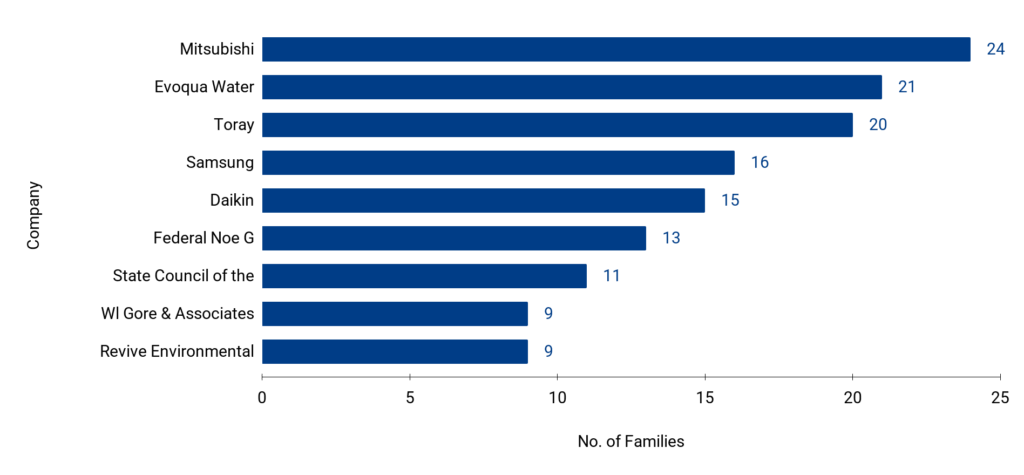

(ii) Top Companies:

Insight: This chart identifies Mitsubishi (24), Evoqua Water Technologies (21), and Toray (20) as the major players in PFAS-free compound patents, indicating their significant R&D investment. Mitsubishi is commercializing PFAS-free oxygen absorbers and resins for packaging and electronics. Evoqua is leading the water remediation market by deploying advanced filtration systems to treat contaminated drinking water. Toray is focused on high-tech materials, launching a PFAS-free mold release film for semiconductors and new water-repellent textiles. These efforts reflect the companies’ drive to capitalize on the rapidly expanding, regulation-driven market for safer, sustainable alternatives.

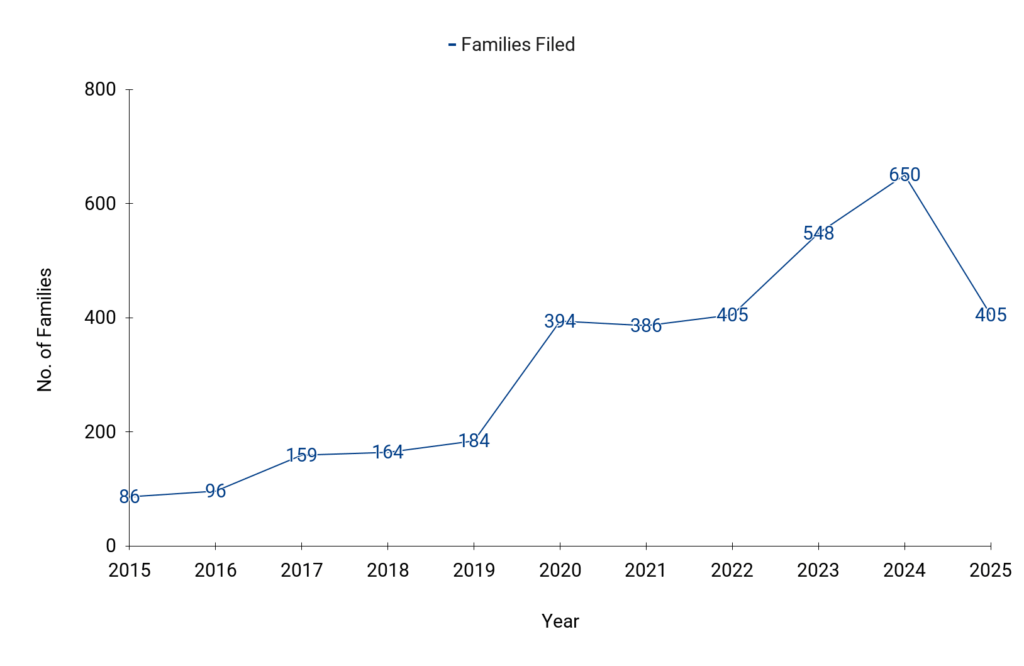

2. Families Filed:

Insight: Patent analytics reveal a sustained rise in activity over the past decade, with filings increasing sharply from 86 families in 2015 to 405 families in 2025. Shanghai University emerged as the leading contributor in 2025 with eight patent families, followed by Nanjing University with 7. This patent boom aligns perfectly with market news on “forever chemicals” (PFAS). Global regulatory pressure (e.g., EU REACH, US EPA) and consumer demand for non-toxic products are driving the PFAS-free chemicals market to a projected CAGR of over 6.5% (for the time frame 2024 to 2030), creating a massive R&D spending opportunity. Companies are therefore rapidly innovating in areas like bio-based polymers, silicones, and advanced coatings to secure their market positions with new, patentable PFAS-free solutions.

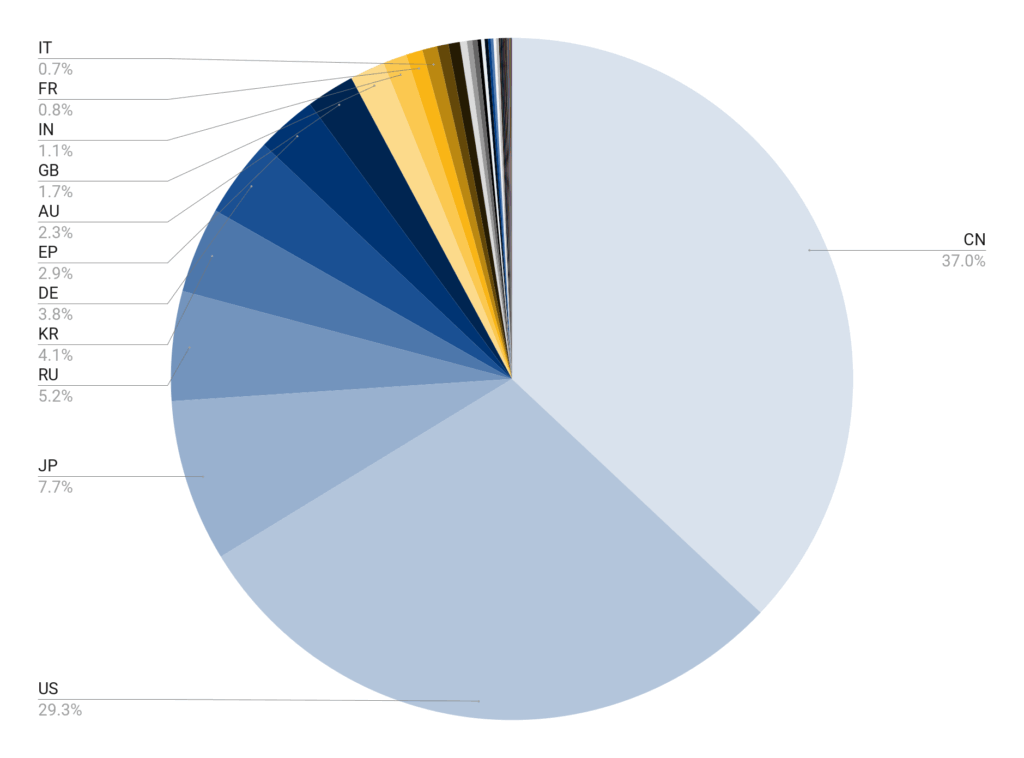

3. Priority Country:

Insight: The pie chart highlights China’s commanding lead in patent priority filings at 37.0%, significantly outpacing the US (29.3%) and Japan (7.7%), demonstrating its position as the global innovation engine for new technologies. This dominance is strongly corroborated by market data in the PFAS-free compounds sector, where China holds the highest number of patents globally for substitutes. Driven by a robust academic-industrial ecosystem and strategic state focus, China is solidifying its control over the intellectual property and manufacturing base for environmentally compliant chemical technologies, securing its market share in critical sectors like coatings and electronics.

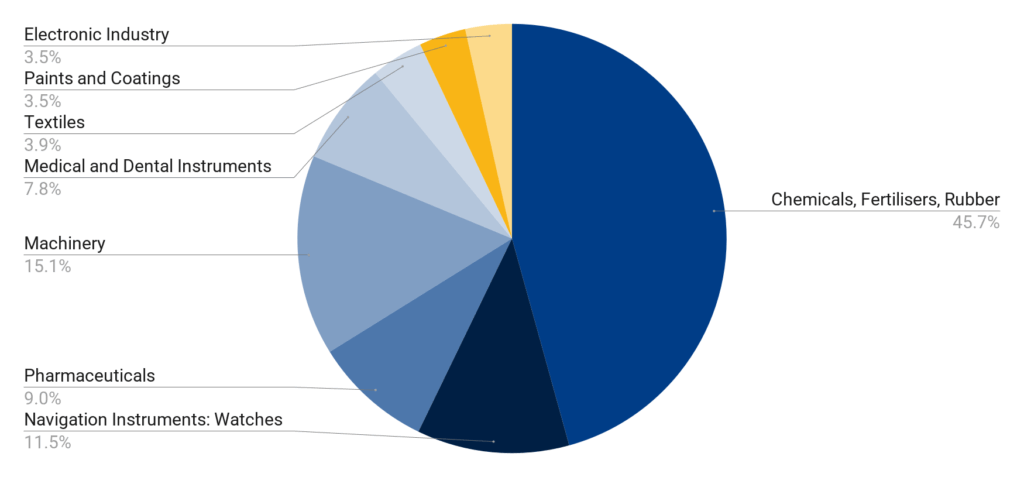

4. Industry:

Insight: In terms of industry sectors, the chemical, fertilizer, and rubber industries account for about 45.7% of the patents, followed by machinery (15.1%) and navigation instruments (11.5%), among others.

Green Innovation – Who’s Leading the PFAS-Free Charge?

As regulators turn up the heat, companies are racing to create safer alternatives. Here are some pioneers:

1. Micro Powders

- POLYGLIDE 1226XF and MPP-123AL are PTFE-free surface modifiers for coatings that provide excellent scratch and scuff resistance and are globally approved for food contact. Their best-in-class engineered composite and nanocomposite additives blend natural and synthetic waxes with high-performance materials like aluminum oxide and ceramic, delivering performance equal to or superior to traditional PTFE-based additives.

2. Green Theme Technologies (GTT)

- EMPEL™ is a water- and solvent-free water repellent made with hydrocarbon monomers that outperforms traditional treatments in rain tests and breathability. Green theme technologies (GTT) filed a patent US20250137196A1 on October 22, 2024, covering a method of applying a precursor coating composition to textile surfaces. The coating is both fluorine- and water-free and includes: (A) a chemical moiety with a Si–H group, (B) a moiety with an alkene group, and (C) a metallic catalyst that drives a hydrosilylation reaction, linking the two moieties to create a durable hydrophobic layer.

3. OrganoClick

- OrganoTex® offers biodegradable, PFAS-free waterproofing inspired by lotus leaves, designed to restore and maintain water repellency in garments, footwear, backpacks, and more. It helps restore performance in outdoor items that typically lose water repellency over time due to frequent use or washing. In the invention covered under patent CN109831917B filed on September 6, 2017, the fluorocarbon-free composition enhances water and soil repellency using siloxanes, alkyl silanes, and natural oils like lotus seed and sunflower oil. Organoclick also offers other PFAS-free solutions, such as OC-BioBinder™, OC-AquaSil™ Tex.

4. HeiQ

- Oilguard is a non-woven fabric designed for oil spill response, offering oil absorption and water repellency to protect shorelines. Treated with a fluorine-free, eco-friendly water-repellent based on polyurethane technology, it provides effective and sustainable beach protection during oil relief efforts. Covered under patent WO2017063038A1 filed on October 13, 2016, the invention details a method for creating durable water-repellent substrates using microfibers and fluorine-free agents such as dendrimers, polyurethane, waxes, and metal-oxide particles. HeiQ also provides additional PFC-free solutions, including HeiQ Eco Dry™.

Note: Several other innovators are offering PFAS-free water-repellent solutions, including Archroma (PHOBOTEX®), Biotex (Bioguard), Clariant (Arkophob®), Devan (H2O Repel), Sarex (Careguard FF), and more. In addition, a range of patent-based PFAS alternatives are emerging, such as biological wax emulsions (CN114411419B), organosiloxane compounds (CN105671970A, US20160298290A1), polycarbodiimide-based solutions (CN107587346A), and polyurethane-based solutions (CN119932917A, CN118288639A).

Conclusion: A Future Beyond Forever Chemicals

The phase-out of PFAS “forever chemicals” is accelerating worldwide due to their environmental persistence and health risks, driving strict regulations in the U.S. and Europe and pushing major producers to halt manufacturing. This transition is fueling rapid innovation in PFAS-free materials, with companies developing sustainable alternatives for textiles, coatings, and other sectors. In this evolving landscape, strong IP insights are critical. MaxVal supports organizations with advanced patent searches, analytics, and competitive intelligence to identify opportunities and safeguard PFAS-free innovations. By safeguarding these innovations, MaxVal empowers companies to navigate the competitive IP landscape with confidence and secure their technological leadership.